Crypto Exchange Bullish Rockets to Nearly $13.2 Billion Valuation in Electrifying NYSE Debut

Quick Summary — What Just Happened

Bullish, a crypto exchange operator alongside CoinDesk, soared into the public markets in spectacular fashion on August 13, 2025. Priced at $37 per share, the IPO raised $1.11 billion, giving Bullish a pre-market valuation of $5.4 billion. But once the trading bell rang, investors pushed the stock past $90, then up to $118, before settling near $92.60. That put Bullish’s market capitalization at nearly $13.2 billion—an explosive debut that shocked even the most optimistic watchers.

Reuters+2Reuters+2Business Insider

The IPO—A Masterclass in Timing and Messaging

Bullish wasn’t just lucky—it was strategic. Here’s how the timeline unfolded:

- Pricing Above Range

Originally aiming for $32–$33, Bullish priced its shares at $37, already signaling strength in investor demand.

ReutersMarketWatch - Massive Capital Raise

With 30 million shares sold, the IPO brought in $1.11 billion—the largest U.S. crypto exchange listing this year.

ReutersMarketWatchThe Economic Times - Investor Fervor Unleashed

Market buzz ignited rapidly—shares opened around $90 (a 150% premium) and spiked as high as $118 during the day.

Reuters+1Business Insider - Valuation Explosion

In mere trading hours, Bullish went from $5.4 billion pre-market to a jaw-dropping $13.2+ billion capitalization.

Reuters+1Business Insider

Why This Matters: The Takeaways Beyond the Numbers

1. Proof of Concept for Crypto Listings

Bullish’s breakout debut signals renewed investor confidence in digital asset firms. Coming amid a broader blockchain IPO revival—including Circle and other major players—it offers a roadmap and morale boost for BTC-focused listings.

New York PostReutersMarketWatch

2. Institutional Strategy Wins

Bullish is not your average retail exchange—it targets institutional clientele. That focus differentiates it, offering steadier revenue potential compared to volatile, sentiment-driven retail-driven platforms.

ReutersBarron’s

3. Crypto Goes Legit

Regulation is backing innovation. With expectations around the Genius Act, supportive legislation, and ETF inflows, crypto is finally shedding tokens’ Wild West image. Bullish’s debut surfs this wave.

Reuters+1New York Post

The Bullish Blueprint—A Closer Look at Strategy & Structure

Delve deeper:

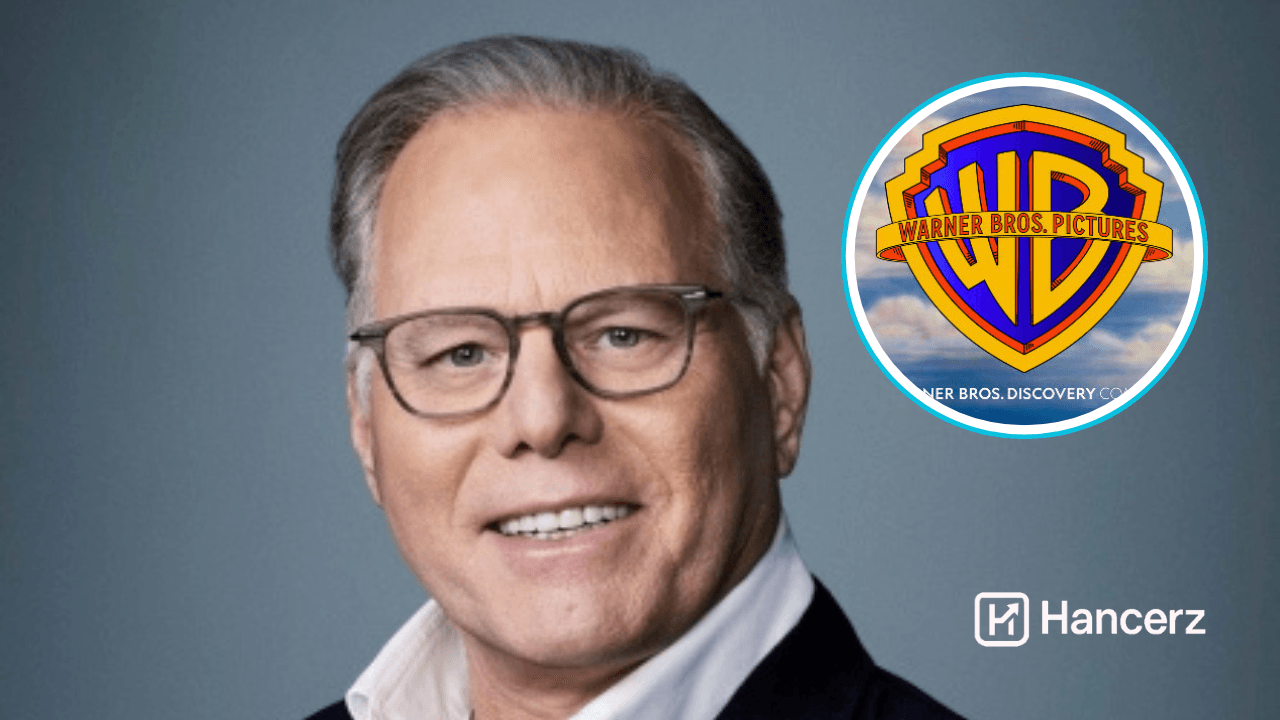

- Leadership pedigree: CEO Tom Farley, a former NYSE president, brings institutional gravitas—charming regulators, boardrooms, and cautious investors alike.

ReutersBarron’s - Integrated media exposure: As CoinDesk owner, Bullish gains built-in content distribution—no gap between trading desk and newsroom, a strategic advantage.

MarketWatchThe Economic Times - Anticipating licensing momentum: Their pending BitLicense in NY positions them well for significant expansion in regulated-markets.

Reuters+1 - Stablecoin diversification: A substantial part of the IPO proceeds is earmarked for stablecoin conversion, playing into the massive on-chain liquidity trend.

Reuters

FAQ — TL;DR for the Curious

| Question | Straight Answer |

|---|---|

| Why did the stock surge so much? | Strong pricing, bullish sentiment, and excitement about crypto’s institutional adoption. |

| Was the IPO overpriced? | Priced above the range, but valuation surged due to aggressive investor demand. |

| Will more crypto firms go public? | Likely—Gemini and Grayscale are in confidential filing stages as part of a broader IPO wave. |

| Is crypto sentiment back? | Absolutely. Bullish debut signals that crypto assets are reentering mainstream finance. |

What’s Next to Watch

- Post-IPO performance—hold firm, or fade after initial frenzy?

- Competitor reactions—will others accelerate listing plans?

- BitLicense approval—a game-changer for institutional operations in NY.

- Market shifts—if BTC or regulatory sentiment shifts, so could the momentum.

Final Thought

Bullish’s NYSE debut wasn’t just a big number—it was a statements day. In one sharp move, it redefined what a crypto company could be: bold, institutional-first, and media-savvy. If this is the start of a ‘crypto summer,’ Bullish may just lead the charge.